bk-info145.site

Tools

What Food Delivery Accepts Cash

accept cash for pickup and delivery orders. Workaround: You can add a banner to your main page letting your customers know that you are accepting cash payments. Accept Ebt Chicago, Chicago Ebt Restaurants, Kathiew Restaurant in Chicago, Cook Your Own Food Restaurant Chicago, Chicago Kamala Restaurant. The food delivery services that accept cash include DoorDash, GrubHub, Uber Eats, bk-info145.site, Seamless, and EatStreet. In addition, you. Get your favorite items delivered to your door. Products. Delivery Anytime. 24/7 Service. + Products. Discover our large product. The Capital One SavorOne Cash Rewards Credit Card is the best credit card for food The payment methods Grubhub accepts are Visa, Mastercard, American. Doordash Icon; Uber Eats Icon; Grubhub; Postmates Icon. *Delivery options and availablility vary by location. Menu prices for delivery are higher. DoorDash, Uber Eats, Grubhub, EatStreet, and Seamless are some of the food delivery services that offer cash payment options, depending on the. There is a new feature in your Deliveroo Rider app: orders can be paid in cash by customers. During this kind of delivery you should pay the restaurant in. Top 10 Best Cash Delivery Food Near San Diego, California · 1. Tacos El Gordo. ( reviews). mi. F St, San Diego, CA () · 2. Shan. accept cash for pickup and delivery orders. Workaround: You can add a banner to your main page letting your customers know that you are accepting cash payments. Accept Ebt Chicago, Chicago Ebt Restaurants, Kathiew Restaurant in Chicago, Cook Your Own Food Restaurant Chicago, Chicago Kamala Restaurant. The food delivery services that accept cash include DoorDash, GrubHub, Uber Eats, bk-info145.site, Seamless, and EatStreet. In addition, you. Get your favorite items delivered to your door. Products. Delivery Anytime. 24/7 Service. + Products. Discover our large product. The Capital One SavorOne Cash Rewards Credit Card is the best credit card for food The payment methods Grubhub accepts are Visa, Mastercard, American. Doordash Icon; Uber Eats Icon; Grubhub; Postmates Icon. *Delivery options and availablility vary by location. Menu prices for delivery are higher. DoorDash, Uber Eats, Grubhub, EatStreet, and Seamless are some of the food delivery services that offer cash payment options, depending on the. There is a new feature in your Deliveroo Rider app: orders can be paid in cash by customers. During this kind of delivery you should pay the restaurant in. Top 10 Best Cash Delivery Food Near San Diego, California · 1. Tacos El Gordo. ( reviews). mi. F St, San Diego, CA () · 2. Shan.

By continuing to use our website after that date, you agree to the revised Terms & Conditions agreement. Accept McDonald's Delivery: Food Delivery Near Me. The Taco Bell app now has delivery! Download the app and see how we deliver more than just your food. Welcome to our Chinese kitchen. Panda Express prepares American Chinese food Accept Cookies. Company Logo. Manage Your Preferences. When you visit our. Serving Families Since Order Online For Dine-In Or Delivery! Fast Delivery. Free Online Ordering. Home of the Legendary Crispy, Curly Pepperoni. Does Grubhub accept cash? · Popeyes Louisiana Kitchen · Taco Bell · Wendy's · McDonald's · Moe's Southwest Grill · Five Guys · Burger King · Pizza Hut. Get food delivery to your doorstep from thousands of amazing local and national restaurants. Find the meal you crave and order food from restaurants easily. Your store should still be accepting cash for deliveries. Delivery experts are expected to take several precautions that include washing their hands before and. About cash payments You can pay for your Bolt Food order via cash on delivery when the courier arrives with your order. You can set your payment method before. Accept Visa, Mastercard, Debit, Alipay, WeChat Pay and cash. Download Our App. Life can be complicated but ordering food doesn't have to be. New users enjoy. Food delivery services that accept cash · DoorDash · Uber Eats · Grubhub · EatStreet · Seamless · Toast Takeout. Toast Takeout is a digital platform designed to. Get unlimited $0 delivery fees and up to 10% off eligible orders from your neighborhood restaurants, grocery stores, and more. Plus, DashPass members get access. The best restaurants near you deliver with Grubhub! Order delivery or takeout from national chains and local favorites! Help support your neighborhood. accept the food. I wish I could upload a picture from last experience. My food was so burnt that it was inedible. They told me it was against their policy. accept cash for pickup and delivery orders. Workaround: You can add a banner to your main page letting your customers know that you are accepting cash payments. Get unlimited $0 delivery fees and up to 10% off eligible orders from your neighborhood restaurants, grocery stores, and more. Plus, DashPass members get access. The Capital One SavorOne Cash Rewards Credit Card is the best credit card for food The payment methods Grubhub accepts are Visa, Mastercard, American. +93%. Restaurants that offer delivery increase sales by 93%. rst-payment-methods-us-en. Accept Square Pay, Apple Pay, Cash App Pay, and Google Pay for faster. You heard it right, Applebee's now offers Delivery! Order online to get food delivered to your home or office fast! One of our nearby drivers will. Accept Ebt Chicago, Chicago Ebt Restaurants, Kathiew Restaurant in Chicago, Cook Your Own Food Restaurant Chicago, Chicago Kamala Restaurant.

Property Owned By Trust

After creating the trust by signing a legal document, the settlor transfers ownership of assets from the settlor's name to the trust's name. If the asset is. Assets are “put” into the box by deeding the real estate to the Trust, and by changing account holders on a financial account. Since personal items like. A land trust takes ownership or authority over a property at the request of its owner, often for tax and privacy purposes but with possible downsides. To add real property to your living trust requires transferring ownership from yourself to the trustee. This is done by updating your deed(s) so that it. The answer is the same as with a revocable trust: the trustee owns any property placed within the trust instrument. That's the entire point of setting up a. The reason this happens is because even though the trust owns legal title to the property, for tax purposes, the trust grantor is still considered the owner. The purpose of creating your living trust is to avoid probate, guardianship proceedings (if you become disabled), and reduce or eliminate federal estate taxes. The purpose of creating your living trust is to avoid probate, guardianship proceedings (if you become disabled), and reduce or eliminate federal estate taxes. There are three basic ways that a home can be acquired for a trust beneficiary. − The trust buys the home and allows the beneficiary to live. After creating the trust by signing a legal document, the settlor transfers ownership of assets from the settlor's name to the trust's name. If the asset is. Assets are “put” into the box by deeding the real estate to the Trust, and by changing account holders on a financial account. Since personal items like. A land trust takes ownership or authority over a property at the request of its owner, often for tax and privacy purposes but with possible downsides. To add real property to your living trust requires transferring ownership from yourself to the trustee. This is done by updating your deed(s) so that it. The answer is the same as with a revocable trust: the trustee owns any property placed within the trust instrument. That's the entire point of setting up a. The reason this happens is because even though the trust owns legal title to the property, for tax purposes, the trust grantor is still considered the owner. The purpose of creating your living trust is to avoid probate, guardianship proceedings (if you become disabled), and reduce or eliminate federal estate taxes. The purpose of creating your living trust is to avoid probate, guardianship proceedings (if you become disabled), and reduce or eliminate federal estate taxes. There are three basic ways that a home can be acquired for a trust beneficiary. − The trust buys the home and allows the beneficiary to live.

In order to make your living trust effective, you need to make sure that the ownership of your house is legally transferred to you as the trustee. Since your. If the asset is real property, the settlor signs a deed conveying the real property to the trust. In addition, if a deceased person owns real property in more. While a living trust is important for protecting the owner's privacy and provides valuable estate planning treatment, the trust provides nothing in the area of. A creditor of the settlor has the same right to go after the trust property as if the settlor still owned the assets in his or her own name. Privacy, A trust. Unlike a will, which is used to give property away after your death, a trust can manage and invest your money and property both during your lifetime and after. The Grantor Retains Full Ownership. When it comes to who legally owns property transferred into a revocable trust, the answer is you, the grantor! Placing. A Florida Revocable Trust is a document that allows you to transfer ownership of most of your assets from yourself to the Trust, with you (or someone you. A trust cannot own, manage, or sell real estate or other property. However, the trustee administering the trust may hold legal title to the property on behalf. Lastly, trusts can offer more flexibility. If you have a revocable living trust, you can add or remove assets from the trust as long as you are in control of. A "living trust" is legally in existence during your lifetime, has a trustee who currently serves, and owns property which (generally) you have transferred to. The beneficiary in a trust has the right to receive all of the beneficial interests in the trust, meaning the fruits or benefits of ownership of the trust. Trusts are a standard tool people use in their estate planning. They allow you to plan for what will happen to your property, savings, and investments after. Trusts can be effective tools for assisting and making life easier for a surviving spouse. They can also be used as part of a strategy to reduce estate. A trust is simply the word used to describe the relationship created when property is transferred by one person (the “settlor”) to another (the “trustee”) to. When it comes to real estate, a trust can ensure that a home stays in the family or that a surviving spouse becomes the sole owner of the house, without the. Using a tenants-in-common deed keeps the property of each owner separate for estate tax purposes. The deed will need to be recorded in the Clerk's Office in the. However, with an irrevocable trust, the settlor gives ownership and control of the property in the trust to the trustee, and no longer owns or controls the. REMEMBER, YOU ARE RESPONSIBLE FOR KEEPING YOUR TRUST FUNDED. DURING YOUR LIFETIME. A. REAL PROPERTY. Most real estate should be held in the name of the Trust. Ownership of a property through a land trust begins with drafting a written land trust agreement. A land trust agreement should appoint the equitable property. A trust is a relationship where someone (the “settlor”) transfers legal ownership of property to someone else (the “trustee”) whose role it is to manage the.

Credit Cards Interest Rates

They can sound enticing but often come with a catch, like a high interest rate. In fact, the average store card now charges a record % APR, according to. The median average credit card interest rate for September is %. Your credit score and credit history will largely determine your credit card interest. View rate information for our family of credit cards ; Scotiabank Value Visa Card, %, % ; ScotiaGold Passport Visa Card, %, % ; Scotiabank. What Is the Average Credit Card Interest Rate? The average interest rate for credit cards is %, as mentioned above, as of the start of Rates have. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer. 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. Investopedia's database reported an average credit card interest of % as of March How Do You Avoid Paying Interest on a Credit Card? There is only. Interest on credit cards tends to be higher than on mortgages or auto loans. CNBC Select answers why issuers charge such high interest and how you can avoid it. Reduce interest payments with a low interest rate credit card. Annual fee $ Purchase interest rate 1 %. Cash interest rate 1 %. They can sound enticing but often come with a catch, like a high interest rate. In fact, the average store card now charges a record % APR, according to. The median average credit card interest rate for September is %. Your credit score and credit history will largely determine your credit card interest. View rate information for our family of credit cards ; Scotiabank Value Visa Card, %, % ; ScotiaGold Passport Visa Card, %, % ; Scotiabank. What Is the Average Credit Card Interest Rate? The average interest rate for credit cards is %, as mentioned above, as of the start of Rates have. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer. 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. Investopedia's database reported an average credit card interest of % as of March How Do You Avoid Paying Interest on a Credit Card? There is only. Interest on credit cards tends to be higher than on mortgages or auto loans. CNBC Select answers why issuers charge such high interest and how you can avoid it. Reduce interest payments with a low interest rate credit card. Annual fee $ Purchase interest rate 1 %. Cash interest rate 1 %.

Average Credit Card Interest Rates: The average credit card interest rate is % for new offers and % for existing accounts, according to WalletHub's. BankAmericard® Credit Card: Best feature: 18 billing cycle introductory rate on purchases and balance transfers. · Discover it® Balance Transfer: Best feature. Category: Interest Rates > Credit Card Loan Rates, 2 economic data series, FRED: Download, graph, and track economic data. Credit card interest is a fee that you're charged when you carry a balance on your credit card from one billing cycle to the next. Whether you're looking for travel points, rewards, cash back, or a lower interest rate, our credit cards have you covered. Credit Card Interest Rates and Interest Charges. Annual Percentage Rate (APR) for Purchases. Visa Signature Rewards %. Visa Platinum Rewards. Interest rates and APRs can be confusing. Learn about the differences, as well as how to develop smart credit card behavior and spending habits. Best low-interest credit cards for September · + Show Summary · Wells Fargo Reflect® Card · Discover it® Cash Back · Bank of America® Customized Cash. The average APR for all cards in the U.S. News database is % to %. Type of rewards card, Average minimum APR, Average maximum APR. Travel. All Cards Featured Travel Cash Back Rewards Points No Annual Fee 0% Intro APR No Foreign Transaction Fee Airline Hotel Balance Transfer. Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online. After the intro period, you'll see an ongoing variable APR of % – % for purchases and balance transfers. There's also a balance transfer fee: 3% of. Graph and download economic data for Commercial Bank Interest Rate on Credit Card Plans, Accounts Assessed Interest (TERMCBCCINTNS) from Nov to May. The average credit card interest rate is % for new offers and % for existing accounts, according to WalletHub's Credit Card Landscape Report. The. A low interest rate credit card is a credit card that has a low APR range. The best low interest credit cards have an APR range that's lower than the national. The purchase interest charge is based on your credit card's annual percentage rate (APR) and the total balance on the card. When do credit cards charge interest. The annual percentage rate (APR) is the cost of borrowing on a credit card. It refers to the yearly interest rate you'll pay if you carry a balance, plus any. The Truist Future credit card allows you to consolidate debt with our lowest credit card rate. Apply online today. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that, 0% intro APR for 15 months; % - % variable. Interest Rates and Interest Charges. Annual Percentage Rate (APR) for Purchases,. Balance Transfers, and. Cash Advances. Visa Gold % to % when you.

Buying A Multi Family Home To Rent

![]()

Owning a multifamily real estate property means you can earn income from multiple rental units in one property versus investing in single-family properties. A duplex is a housing unit with a single shared wall that can accommodate two families. The floor plans of these units typically mirror one another but can vary. When you buy multi-family home rental properties, you may find the property appreciates more slowly compared to rental homes. But overall, if rents increase. Many homeowners have a rental property that is part of their current home, such as a duplex, triplex, or just a rented-out basement apartment. In this. Can you buy a multifamily property with a VA loan? The good news is you can buy a duplex, a triplex or a four-plex using your VA home loan benefits. However. Can you buy a multifamily property with a VA loan? The good news is you can buy a duplex, a triplex or a four-plex using your VA home loan benefits. However. Purchasing a multifamily home gives you the opportunity to live in one unit while renting the others out to generate regular, passive income. What are the. Multi-family real estate investing · Yearly rental tenants that pay rent monthly · Executive, temporary, or transitional housing rentals · Vacation rentals and. When you buy a multi-unit building, you have the added advantage of tenants who pay rent, reducing your cost of ownership. You get the benefit. Owning a multifamily real estate property means you can earn income from multiple rental units in one property versus investing in single-family properties. A duplex is a housing unit with a single shared wall that can accommodate two families. The floor plans of these units typically mirror one another but can vary. When you buy multi-family home rental properties, you may find the property appreciates more slowly compared to rental homes. But overall, if rents increase. Many homeowners have a rental property that is part of their current home, such as a duplex, triplex, or just a rented-out basement apartment. In this. Can you buy a multifamily property with a VA loan? The good news is you can buy a duplex, a triplex or a four-plex using your VA home loan benefits. However. Can you buy a multifamily property with a VA loan? The good news is you can buy a duplex, a triplex or a four-plex using your VA home loan benefits. However. Purchasing a multifamily home gives you the opportunity to live in one unit while renting the others out to generate regular, passive income. What are the. Multi-family real estate investing · Yearly rental tenants that pay rent monthly · Executive, temporary, or transitional housing rentals · Vacation rentals and. When you buy a multi-unit building, you have the added advantage of tenants who pay rent, reducing your cost of ownership. You get the benefit.

Delegation, risk-sharing, and life of loan servicing are the pillars that support our platform, and because of them we are able to make workforce rental housing. purchase of multifamily rental housing properties. In addition, we administer rental assistance and preservation programs to provide stability, climate. Scalability. It is much easier to scale your real estate portfolio by investing in multiple units at once vs. buying single-family homes or condos to rent. When apartment building owners invest in single-family flips or when serial house flippers invest in multi-family homes, a new door of opportunity is opened for. One benefit to owning multifamily property is that it can typically be purchased with one straight-forward, traditional bank loan. Compare purchasing a unit. Download the Multifamily Rental Financing Program Underwriting Guidelines here. Affordable Housing Gap Subsidy (AHGS) Program View below the AHGS Program. Multifamily investment refers to buying multifamily properties like apartment complexes, condominiums, and student housing that offer multiple units for rent. bk-info145.site Income Potential One of the biggest benefits of owning a multi-unit property is the potential for rental income. If you purchase a duplex, for example. There is no such thing as a VA loan for multifamily homes per se. All VA mortgages are single-family home loans approved for up to four living units. You won't. Another key component are the operating expenses for the property. It's important to select a home in an area with moderate to high rents and low operating. New investors can find great investment opportunities with multifamily properties. Some multifamily choose to live in one of their multifamily units, known as. Rental Income- The owner living in a multi family will have units to rent out to help offset the cost of the mortgage and other housing expenses. Shared. Multifamily investment refers to buying multifamily properties like apartment complexes, condominiums, and student housing that offer multiple units for rent. A quick and easy way to analyze any multifamily rental property investment! Analyze a potential deal using all 6 investor metrics. A buyer could buy a duplex, triplex, or beyond with just about the same amount of capital as a typical single family home purchase of similar size. It does come. Thankfully, to use rental income as a way to qualify, it is not necessary for the property you're purchasing to have a current tenant. Lenders are willing to. You'll need to keep detailed records of all of your expenses and activities related to the property, as well as any income you earn from renting it out. It's. Owning multiple rental properties can lead to greater potential long-term return on investment (ROI). That's because more rental properties can generate more. A duplex is a housing unit with a single shared wall that can accommodate two families. The floor plans of these units typically mirror one another but can vary. Conventional financing also assumes that when you purchase a property as a primary residence that you will be living there for 12 continuous months, however, if.

Can I Get A Collateral Loan On My Car

This type of loan is relatively risk-free for the lender, as they have the option to liquidate or auction the asset (the car) in case you. A title loan is a way to borrow money against your motor vehicle. Based on your vehicle's value, a lender determines how much money you can borrow. In order to obtain a secured title loan, an eligible applicant must pledge a qualifying car or truck as collateral to guarantee the loan Apply for secured. Car title loans can be predatory lending tools that trap borrowers in high-interest cycles. Before using your car as collateral, carefully consider the. How Can I Use My Car as a Collateral for A Loan? A car title loan is a type of secured loan that allows the borrower to use the title to a vehicle as collateral. A benefit of a collateral loans near me is you can drive your car while you repay the loan. Getting a collateral loan won't interfere with your transportation. By securing their loans with collateral, lenders are able to offer lower interest rates, less fees and other costs because there is a safety net attached to. Looking to get title loans for cars not paid off yet? You might be wondering, “Can I use my car as collateral if I still owe on it?” The answer is yes! You. To use your car as collateral, you must have equity in the vehicle. Equity is the difference between what the car is worth and what you owe on it. For example. This type of loan is relatively risk-free for the lender, as they have the option to liquidate or auction the asset (the car) in case you. A title loan is a way to borrow money against your motor vehicle. Based on your vehicle's value, a lender determines how much money you can borrow. In order to obtain a secured title loan, an eligible applicant must pledge a qualifying car or truck as collateral to guarantee the loan Apply for secured. Car title loans can be predatory lending tools that trap borrowers in high-interest cycles. Before using your car as collateral, carefully consider the. How Can I Use My Car as a Collateral for A Loan? A car title loan is a type of secured loan that allows the borrower to use the title to a vehicle as collateral. A benefit of a collateral loans near me is you can drive your car while you repay the loan. Getting a collateral loan won't interfere with your transportation. By securing their loans with collateral, lenders are able to offer lower interest rates, less fees and other costs because there is a safety net attached to. Looking to get title loans for cars not paid off yet? You might be wondering, “Can I use my car as collateral if I still owe on it?” The answer is yes! You. To use your car as collateral, you must have equity in the vehicle. Equity is the difference between what the car is worth and what you owe on it. For example.

Our lenders strive to have same-day approvals! NO PRE-PAYMENT PENALTY. Let's face it, we all want to pay off our vehicles early. Let us help you do. If you're in need of fast cash and own your vehicle outright, using your car as collateral for a loan could be a great option. This process, known as a car. Your credit score, income, and income to debt ratio will all factor into your borrowing limit. So if your credit score is not high or strong enough to get the. Get more money by using your car title to secure a loan. Fixed, affordable payments available. Prequal won't affect your credit score. Using your vehicle as collateral for a personal loan means you may qualify for a larger loan amount to take care of needs like furniture, appliances, auto. Lenders Love Low-Risk Car Title Loans. Because your vehicle is put up as collateral, these loans are very low-risk for lending institutions. Your vehicle is. Did you know using car as a collateral, you will get personal secure loans, car title loans and cash back auto loans. Read on to learn more in detail. If you want to use your car as collateral, we can let you know how much money you can borrow, your interest rate and your approximate loan repayment amount. Some lenders will accept vehicles as collateral if you have sufficient equity in your vehicle and wish to put up the title as security. A handful of banks will. You can calculate your car's equity by subtracting the remainder of your car loan from the vehicle's current market value. Look for a Lender. Once you have an. Can I use my car as collateral? Yes. Some banks refer to this as loans against car. It's best to check with your bank if they offer such an option for. Title loans, also known as car title loans or auto title loans, are a type of secured loan where borrowers use their vehicle title as collateral in exchange for. You may be able to take a loan out against a car (or another vehicle) if you meet the lender's criteria. This is known as a logbook loan. A car title loan is a short-term loan in which the borrower's car is used as collateral against the debt. Borrowers are typically consumers who do not. When you take out a car title loan, you are borrowing money and giving the lender the title to your car as collateral. This means that the lender can repossess. Most passenger car makes and models can be used as collateral for a personal loan. To qualify, your car must be. It turns out there are few requirements for a collateral loan other than having proof that you own a vehicle with significant equity. Most applicants can. If you are fortunate to own a classic/antique car, a title pawn collateral loan offers an appealing means of generating additional capital without having to. An auto-secured loan, also called an auto-secured transaction, secured car loan, or collateral car loan--allows you to use your automobile as collateral for a. Title loan lenders use the title of your vehicle and your ability to pay back the loan to initially determine eligibility. No title on your car – no car title.

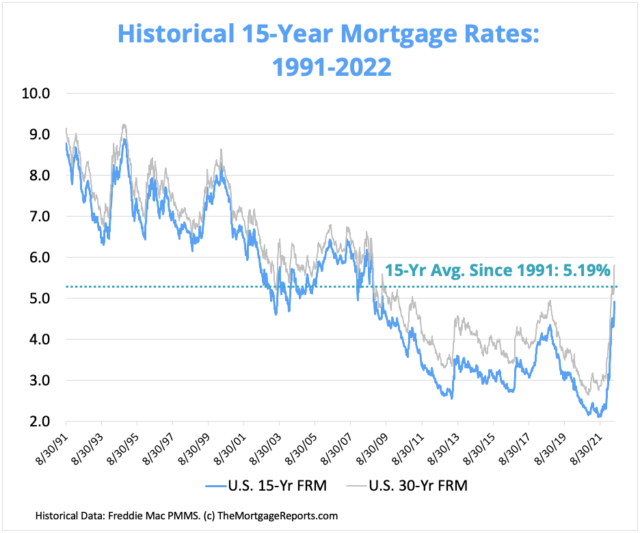

15 Year Refinance Apr

Compare year fixed rates from multiple lenders to find the best year mortgage rate. What is the current rate for a year, fixed-rate mortgage? Find out what the current year, fixed-rate mortgage rates look like and apply today! Check out current refinance rates for a year conventional fixed-rate loan. These rates and APRs are current as of 08/30/ and may change at any time. The option to take out a year refinancing home loan can be an effective and aggressive approach to paying off your house and saving on interest costs. Rates on year mortgages are usually lower than year mortgage rates, which means you can save a lot by simply choosing a year loan term. The following table shows current year mortgage refinancing rates available in Mountain View. You can use the menus to select other loan durations. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. The average rate for a year fixed-rate mortgage has stayed in the 6 percent range, hitting a low of percent in January, according to Bankrate data. Compare year fixed rates from multiple lenders to find the best year mortgage rate. What is the current rate for a year, fixed-rate mortgage? Find out what the current year, fixed-rate mortgage rates look like and apply today! Check out current refinance rates for a year conventional fixed-rate loan. These rates and APRs are current as of 08/30/ and may change at any time. The option to take out a year refinancing home loan can be an effective and aggressive approach to paying off your house and saving on interest costs. Rates on year mortgages are usually lower than year mortgage rates, which means you can save a lot by simply choosing a year loan term. The following table shows current year mortgage refinancing rates available in Mountain View. You can use the menus to select other loan durations. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. The average rate for a year fixed-rate mortgage has stayed in the 6 percent range, hitting a low of percent in January, according to Bankrate data.

15 Year Mortgage Rate is at %, compared to % last week and % last year. This is higher than the long term average of %. The 15 Year Mortgage. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. A year fixed mortgage helps borrowers save on interest and pay off their home loan faster. Looking for a fixed interest rate and a shorter loan term? A Refinance rates ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %. Compare year mortgage rates when you refinance your loan. Save money by comparing current year mortgage rates from NerdWallet. Graph and download economic data for Year Fixed Rate Mortgage Average in the United States (MORTGAGE15US) from to about year. Refinancing to a year mortgage can save you hundreds of thousands of dollars over the life of your loan, according to LendingTree data. At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Here's how their refinance options. What if you decide to pay off that same $, loan amount in half the time? A year mortgage would have with a rate of % (APR %) a principal and. Compare year fixed mortgage refinance rates from top mortgage lenders, tailored to you. Get actual prequalified rates in minutes. Today's Year Refinance Rates. The current average rate on a year refinance is % compared to the rate a week before of %. The week high for a Interested in refinancing your mortgage? View today's mortgage refinance rates for fixed-rate year fixedRate Mortgage popup. Rate %. APR %. The option to take out a year refinancing home loan can be an effective and aggressive approach to paying off your house and saving on interest costs. I am trying to figure out what loan option is the best. Should I take out a 15y or a 30y with the intention of paying the 15y amount every month? year fixed rate:APR %. +%. Today. %. Over 1y. 5-year ARM rate:APR year fixed. Farmers Bank of Kansas City. NerdWallet rating. APR. Stability: You'll be able to lock the interest rate on your mortgage for the entire year term. This gives you a degree of predictability you won't have with. Today's competitive refinance rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · The following table shows current year mortgage refinancing rates available in Mountain View. You can use the menus to select other loan durations. The year mortgage has some advantages when compared to the year, such as less overall interest paid, a lower interest rate, lower fees, and forced savings. A year mortgage rate specifically is the annual rate of interest you can expect to pay on a mortgage that lasts 15 years.

Why Do I Lose Weight When I Eat Bad

Can you eat too much fruit? Get our expert's view. Get our recipe for If you would like more guidance on reducing portion sizes to help you lose weight. eat to fewer calories each day. Low-carb diets, especially very low-carb diets, may lead to greater short-term weight loss than do low-fat diets. One possible reason is that junk food is often high in sugar, which can lead to an initial burst of energy followed by a crash. This can make. The secret to losing weight is consuming fewer calories than you utilize during the day. Thus, whether these calories come from nuts or bread, you will lose. “This causes your cells and body to crave food which causes you to eat a lot. We usually tend to crave unhealthy foods and all attempts at eating healthy go out. Everyone needs some fat in their diet, so no one should eat a completely fat-free diet. How Can I Lose Weight Safely? Eating healthy meals and snacks and. 11 Foods to Avoid When Trying to Lose Weight · 1. French fries and potato chips · 2. Sugary drinks · 3. White bread · 4. Candy bars · 5. Some fruit juices · 6. To lose weight, you must create an energy deficit. You can do this by either increasing the number of calories you burn or reducing your calorie intake. Calorie. When trying to lose weight, it is important to limit those that are high in calories, sugars, and unhealthful fats but low in nutrients. Learn more here. Can you eat too much fruit? Get our expert's view. Get our recipe for If you would like more guidance on reducing portion sizes to help you lose weight. eat to fewer calories each day. Low-carb diets, especially very low-carb diets, may lead to greater short-term weight loss than do low-fat diets. One possible reason is that junk food is often high in sugar, which can lead to an initial burst of energy followed by a crash. This can make. The secret to losing weight is consuming fewer calories than you utilize during the day. Thus, whether these calories come from nuts or bread, you will lose. “This causes your cells and body to crave food which causes you to eat a lot. We usually tend to crave unhealthy foods and all attempts at eating healthy go out. Everyone needs some fat in their diet, so no one should eat a completely fat-free diet. How Can I Lose Weight Safely? Eating healthy meals and snacks and. 11 Foods to Avoid When Trying to Lose Weight · 1. French fries and potato chips · 2. Sugary drinks · 3. White bread · 4. Candy bars · 5. Some fruit juices · 6. To lose weight, you must create an energy deficit. You can do this by either increasing the number of calories you burn or reducing your calorie intake. Calorie. When trying to lose weight, it is important to limit those that are high in calories, sugars, and unhealthful fats but low in nutrients. Learn more here.

This is caused by increased levels of leptin, a hormone secreted by fat cells and responsible for maintaining energy balance in the body. After eating a larger. These weight loss tips will help you move more and eat healthier Things you can do to lose weight. You do not have to do everything at once. I take on a challenge to see if I can lose weight only eating junk food from fast food restaurants is it even possible? If you remove those ultra-process foods and give them the same calories, they report liking the food just as much, yet they lose weight, and they eat fewer. Emotional eating can sabotage your weight-loss efforts. It often leads to eating too much — especially too much of high-calorie, sweet and fatty foods. The good. Sometimes people who have a history of an eating disorder (like anorexia or bulimia) want to lose weight for perfectly healthy reasons. Maybe it would help with. Eating protein with meals Protein can regulate appetite hormones to help people feel full. This is mostly due to a decrease in the hunger hormone ghrelin and. During the first few weeks of losing weight, a rapid drop is typical. In part, this is because when you initially cut calories, the body gets needed energy by. This is caused by increased levels of leptin, a hormone secreted by fat cells and responsible for maintaining energy balance in the body. After eating a larger. It's not your imagination: When you try to lose weight, you're fighting not only your cravings but also your own body. Weight loss decreases the hormone leptin. Cravings for junk food are common reasons people 'fall off the wagon' with their healthy eating plans. They can lead to unhealthy eating habits and be one of. The problem is that when we go without food, fat-storing enzymes increase and metabolism decreases as a means of preservation. So, when people do eat, they. If exercise drains a big chunk of the calories you're eating and there aren't enough left to fuel your body's day-to-day processes—a condition known as low. Your feelings about food. The emotional part of trying to lose weight is important and can often be overlooked. Do you feel guilty when you eat a treat? Do. Medications: Sometimes, medications can cause issues such as altered taste or smell, decreased desire to eat, dry mouth, issues with swallowing, or nausea and. When you space out your meals too much, your metabolism slows down and isn't able to burn off all the calories you eat in your next meal. Those extra calories. Your feelings about food. The emotional part of trying to lose weight is important and can often be overlooked. Do you feel guilty when you eat a treat? Do. If we absorb more energy than we expend, we gain weight. If we absorb less energy than we expend, we lose weight. This has been tested over and over again by. What Should You Eat After a Hike? A person eating a. These weight loss tips will help you move more and eat healthier Things you can do to lose weight. You do not have to do everything at once.

Average Home Mortgage Payment

A mortgage is a long-term loan designed to help you buy a house. In addition to repaying the principal, you also have to make interest payments to the. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. While principal, interest, taxes, and insurance make up the typical mortgage Your monthly mortgage payment will depend on your home price, down payment, loan. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. Mortgage Payment Table ; %. $, $1,, $, $1, Monthly Pay: $1, ; Monthly, Total ; Mortgage Payment, $1,, $, ; Property Tax, $, $, ; Home Insurance, $, $45, ; Other. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. A mortgage is a long-term loan designed to help you buy a house. In addition to repaying the principal, you also have to make interest payments to the. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. While principal, interest, taxes, and insurance make up the typical mortgage Your monthly mortgage payment will depend on your home price, down payment, loan. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. Mortgage Payment Table ; %. $, $1,, $, $1, Monthly Pay: $1, ; Monthly, Total ; Mortgage Payment, $1,, $, ; Property Tax, $, $, ; Home Insurance, $, $45, ; Other. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments. Once we calculated the typical closing costs in each county we divided that figure by the county's median home value to find the closing costs as a percentage. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. Use Zillow's home loan calculator to quickly estimate your total mortgage payment The calculator auto-populates the current average interest rate. PMI. Know the average down payment and mortgage costs for buying a house in Canada. Compare mortgage offers using our short online form, free of charge and no. Find average mortgage rates for the 30 year Monthly Pymt. $1, More Mortgage Calculators. Mortgage Payment w/ Amortization · Mortgage Loan Comparison. The Factors That Determine Your Monthly Mortgage Payment · Yr. Conforming. %. Day Range: % - % · Yr. FHA. %. Day. Use a Mortgage Calculator like the one below to help you determine your monthly mortgage payment and the time it would take to pay off your debt. Average semi-detached houses in the borough were priced at £ million in December , resulting in a mortgage payment of £16, per month. This figure. M = monthly mortgage payment · P = the principal amount · i = monthly interest rate. Typically, lenders like to present interest rates on an annual basis, so you'. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Average Mortgage Size in the United States decreased to Thousand USD in July 31 from Thousand USD in the previous week. This page includes a. Using these figures, your monthly mortgage payment should be no more than $2, The 35% / 45% model. With the 35% / 45% model, your total monthly debt. The average monthly mortgage payment is now $2,, and that is a 15% increase from August and almost 50% higher than in when the average payment was. Mortgage costs may vary depending on where you live. In California, the average monthly mortgage payment is $1, That said, actual prices will differ per. Use our mortgage calculator to get an idea of your monthly payment by adjusting the interest rate, down payment, home price and more. If you have to pay an interest rate of % instead of % on your loan, your monthly payment will cost $ more. The total cost of your mortgage will also. Median home values were calculated for counties and county-equivalents in the U.S. Home values represent the value of all homes, not home sales. Use our free mortgage calculator to get an estimate of your monthly mortgage payments, including principal and interest, taxes and insurance, PMI, and HOA.

How To Put Your Apartment Up For Rent

bk-info145.site has teamed up with Avail to help landlords list vacant rental property for free. You can publish your listing to more than 12 websites, manage leads. Tenants may place rent in an escrow account when a landlord will not fix housing violations. up paint chips and put them in their mouths. Lead is especially. Create your rental listings. It takes just minutes to create a listing — simply add property details, upload photos and publish. · Message interested renters. There are rental apps that not only provide up-to-date apartment availability and more precise search options, but also speed up the application process. a. Keep your apartment or house safe and sanitary. b. Dispose of trash and garbage properly—do not let it pile up or put. Up to Code and Regulations · Apply for Basic Business License · Submit the necessary forms and documents (rent control status, clean hands certification) · Get. House, Condo, Duplex · Access digital tools to accept online applications · Quickly qualify renter leads and screen prospective tenants · Get full support from our. If you request it in writing, a landlord must give you a copy of a lease before you decide whether to rent. It must include all agreed upon terms, but it does. Make a financial plan. · Set a rental rate. · Have a property management plan. · Learn landlord tenant law. · Set rental policies and write a lease. · Create a. bk-info145.site has teamed up with Avail to help landlords list vacant rental property for free. You can publish your listing to more than 12 websites, manage leads. Tenants may place rent in an escrow account when a landlord will not fix housing violations. up paint chips and put them in their mouths. Lead is especially. Create your rental listings. It takes just minutes to create a listing — simply add property details, upload photos and publish. · Message interested renters. There are rental apps that not only provide up-to-date apartment availability and more precise search options, but also speed up the application process. a. Keep your apartment or house safe and sanitary. b. Dispose of trash and garbage properly—do not let it pile up or put. Up to Code and Regulations · Apply for Basic Business License · Submit the necessary forms and documents (rent control status, clean hands certification) · Get. House, Condo, Duplex · Access digital tools to accept online applications · Quickly qualify renter leads and screen prospective tenants · Get full support from our. If you request it in writing, a landlord must give you a copy of a lease before you decide whether to rent. It must include all agreed upon terms, but it does. Make a financial plan. · Set a rental rate. · Have a property management plan. · Learn landlord tenant law. · Set rental policies and write a lease. · Create a.

a. Keep your apartment or house safe and sanitary. b. Dispose of trash and garbage properly—do not let it pile up or put. You may be able to pay your rent into a separate bank account. This is called paying in escrow. To do this, call your bank and ask to set up an escrow account. You may be able to pay your rent into a separate bank account. This is called paying in escrow. To do this, call your bank and ask to set up an escrow account. putting your house up for sale. Sometimes homeowners from Arizona come to San Diego and rent for a few months to escape the heat. Moreover. 1. Go to the bk-info145.site home page and sign up for a free account. Select the "Sign in or Join" tab on the top right corner of the home page. up any of your rights under law. Q The magistrate may let you stay if you can show that your apartment is not worth the rent the landlord wants for it. Moreover, incorporating pre-defined categories on rental property websites allows renters to filter properties based on their requirements and preferences. Every property owner and manager knows that in order to effectively market your building and sign more leases, you have to list your vacancies on apartment. For your protection, you should only enter into a written lease. The lease says what you are responsible for, and what the landlord is responsible for. Both you. New Apartment Checklist · Be Prepared · Fees and Deposits · Ask for a Lease · Read your Lease · Who is on the Lease? · Roommates? · Rent-Stabilized? · Landlord's Right. 1) Understand New York's rental laws · 2) Know your co-op or condo sublet rules · 3) Make sure building documents are up to date · 4) Avoid illegal short-term. Several map overlays for renters to pre-qualify their search · Covers condos, apartments, houses, and townhouses · Prospective tenants pay a fee. 10 Steps To Follow When Renting an Apartment · 1. Know your budget so you can pay rent · 2. Decide if you'll have a roommate · 3. Determine where you want to live. If you put rent in an escrow account, it should be a separate account at a bank with only your rent funds in it. Tell your landlord in writing that you're. Tenants may place rent in an escrow account when a landlord will not fix housing violations. up paint chips and put them in their mouths. Lead is especially. How do I write an effective apartment listing? · Start with a catchy headline highlighting key features · Begin the description with your apartment's best. See the rental units in person to evaluate their condition. Contact landlords to set up a date and time to get a tour of the apartment. If you're interested in. Essentially, it's like running through a home safety checklist; you walk through the apartment with your landlord or rental agent and determine if there are any. Before you buy a condo or apartment to rent out, contact the condo owner association (COA) to learn about rental policies and restrictions. What you need to know · Finding an apartment and signing a lease · Mandatory statement of condition · Security deposits and last month's rent · Landlord's guide to.

Seamless New Customer

$10 off First Order From Seamless (food delivery) Get $10 off your first order! Must be new customer. bk-info145.site Track job changes of your most valuable customers to get new contact info automatically. Fuel Your Pipeline. Data Enrichment. Turn any email, phone, or. Save at Seamless with 12 active coupons & promos verified by our experts. Choose the best offers & deals starting from 20% to 40% off for September ! Seamless customer service refers to a company's ability to provide a smooth experience without any obstacles throughout a customer's omnichannel journey. New account signups only. Discount is provided in the form of cashback directly from NachoNacho. For questions related to your discount, please reach out to us. Using online ordering platforms like Seamless? Yes, you are gaining new orders and new customers, but you are also losing a lot of commission fees and your. Save $10 with 3 verified Seamless promo codes for September SimplyCodes uses AI and crowdsourcing to find Seamless coupons that actually work! 9+ active Seamless Promo Codes, Voucher Codes & Deals for Sep Most popular: 30% Off $10+ Orders for New Diners with Seamless Promo Code: GH30*****. Once you create a Seamless account, you'll get a code for $10 off your first order. For $/month, you can become a Seamless+ member with perks like free. $10 off First Order From Seamless (food delivery) Get $10 off your first order! Must be new customer. bk-info145.site Track job changes of your most valuable customers to get new contact info automatically. Fuel Your Pipeline. Data Enrichment. Turn any email, phone, or. Save at Seamless with 12 active coupons & promos verified by our experts. Choose the best offers & deals starting from 20% to 40% off for September ! Seamless customer service refers to a company's ability to provide a smooth experience without any obstacles throughout a customer's omnichannel journey. New account signups only. Discount is provided in the form of cashback directly from NachoNacho. For questions related to your discount, please reach out to us. Using online ordering platforms like Seamless? Yes, you are gaining new orders and new customers, but you are also losing a lot of commission fees and your. Save $10 with 3 verified Seamless promo codes for September SimplyCodes uses AI and crowdsourcing to find Seamless coupons that actually work! 9+ active Seamless Promo Codes, Voucher Codes & Deals for Sep Most popular: 30% Off $10+ Orders for New Diners with Seamless Promo Code: GH30*****. Once you create a Seamless account, you'll get a code for $10 off your first order. For $/month, you can become a Seamless+ member with perks like free.

Seamless, also known as SeamlessWeb, is the premier food ordering service on the internet. It was introduced in as a food delivery platform for. 20% Off Delivery (Minimum Order: $) New Customers Only at Seamless. Aug 21 53 mo ago Seamless offers a seamless returns process, ensuring customer. New users can sign up for the Promotions at the Business Customer Gateway. Service to perform automated verifications of Seamless mailings by. New account signups only. Discount is provided in the form of cashback directly from NachoNacho. For questions related to your discount, please reach out to us. 25% Off Your First App Order Over $15 ownload our app and enjoy 25% off your first order of $15 or more. It's that easy to save! Please reach out to a member of our Customer Care team at Thank you. more. retnuh1, 06/. Kathy says: Love the service in bagel market- always with a smile! Chester's Chicken. Sandwich•See menu. New. Bruckner Blvd, The Bronx, NY, New. Today's best bk-info145.site coupons include 25% off on your order, $10 off orders in New York City, 20% off your order for new customers, $15 off your order, and. In the race to digitally transform, new teams and workflows are being added on top of existing workflows. While they are dependent on one another to deliver. You will discover new products, featured collections, best sellers, and customer favorites from the Seamless online catalog. Don't worry. We'll back you up with. Save money on your online shopping with today's most popular bk-info145.site promo codes & coupon codes. ✔️✔️✔️ With WorthEPenny, saving is much easier than ever! Get 25% Off Orders $15+ · Get $7 Off Orders $12+ · Take 40% Off 3 Orders with Promo Code · Free Delivery on Order $15+ for New Customers · Seamless Coupons and. You can contact them by calling Shopping Tips. Seamless Deals. Use your address at Seamless to unlock all the special deals for your. Place and order over $2, or more in gift cards or egift cards today. *Orders require a new account on the bulk portal and prepayment via ACH. Buy in bulk. $12 off your first order · Hungry? Try Seamless! Use my link on your first order and we'll both get $12 off. Seamless gives you $15 off your first two orders of more than $20 if you're currently a student, and you do need a UNiDAYS account to access the discount. Does. Log in to your Seamless account. Once logged in you can order online from local restaurants that deliver in your area and to your address, get coupons and. If you require assistance, please call our Customer Care team at New York County, New York. The foregoing Governing Law and Venue. Get $10 off your first order! Must be new customer. bk-info145.site With this definition in mind, a seamless customer experience is a customer journey that is devoid of any mistakes, delays, or setbacks. In other words, this.